Conservative

Listed Security SMA Conservative

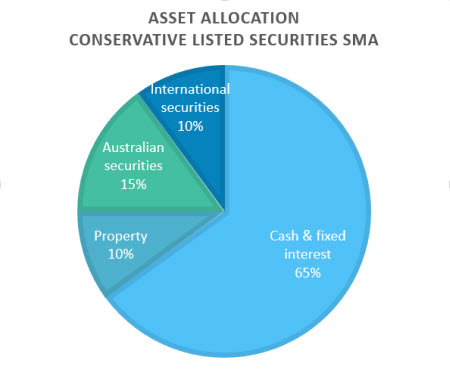

This portfolio invests mainly in defensive assets such as fixed interest securities, but it also includes significant investment in assets such as equities to provide some capital growth.

| Asset class | Asset allocation | ||

|---|---|---|---|

| Expected long-term average | Min | Max | |

| Cash & Fixed interest | 65% | 40% | 100% |

| Property | 10% | 0% | 20% |

| Australian equities | 15% | 0% | 25% |

| International equities | 10% | 0% | 15% |

| TOTAL | 100% | ||

| % in Growth Assets | 35% | ||

Investment Objective

To produce a Return (before tax and after investment fees) that equals inflation plus 2.5% p.a.over rolling 8-year periods.

Who is this for?

This portfolio is suited to investors who are seeking a reasonable degree of capital stability, but who also want some protection of the value of their assets against the effects of inflation.

Expected returns over 10 year period

| Income per annum | 3.20% |

| Capital Growth per annum | 1.44% |

| TOTAL per annum | 4.64% |

| Franking Credits included in income | 0.20% |

Expected risks of return shortfalls

| Chance of return falling short of investment objective over a 10-year period | 20% |

| Chance of a negative return in any one year | 10% |