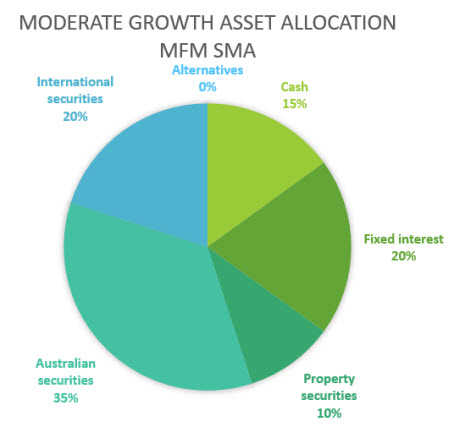

Moderate Growth

Managed Fund Model SMA Moderate Growth

This portfolio has a higher level of investment in growth assets which are subject to volatile markets. It is expected to have lower short-term fluctuations in value than the other more growth-based investment portfolios. The aim is to produce moderate capital growth in a medium- to long-term time frame.

| Asset class | Asset allocation | ||

|---|---|---|---|

| Expected long-term average | Min | Max | |

| Cash | 15% | 5% | 30% |

| Fixed interest | 20% | 20% | 30% |

| Property securities | 10% | 0% | 25% |

| Australian equities | 35% | 0% | 60% |

| International equities | 20% | 0% | 45% |

| Alternative equity assets | 0% | 0% | 15% |

| TOTAL | 100% | ||

| % in Growth Assets | 65% | ||

Investment Objective

To produce a Return (before tax and after investment fees) that equals inflation plus 3.5% p.a.

Who is this for?

This portfolio is suited to investors who can accept more risk of a negative return in any one year in exchange for higher returns over the longer term.